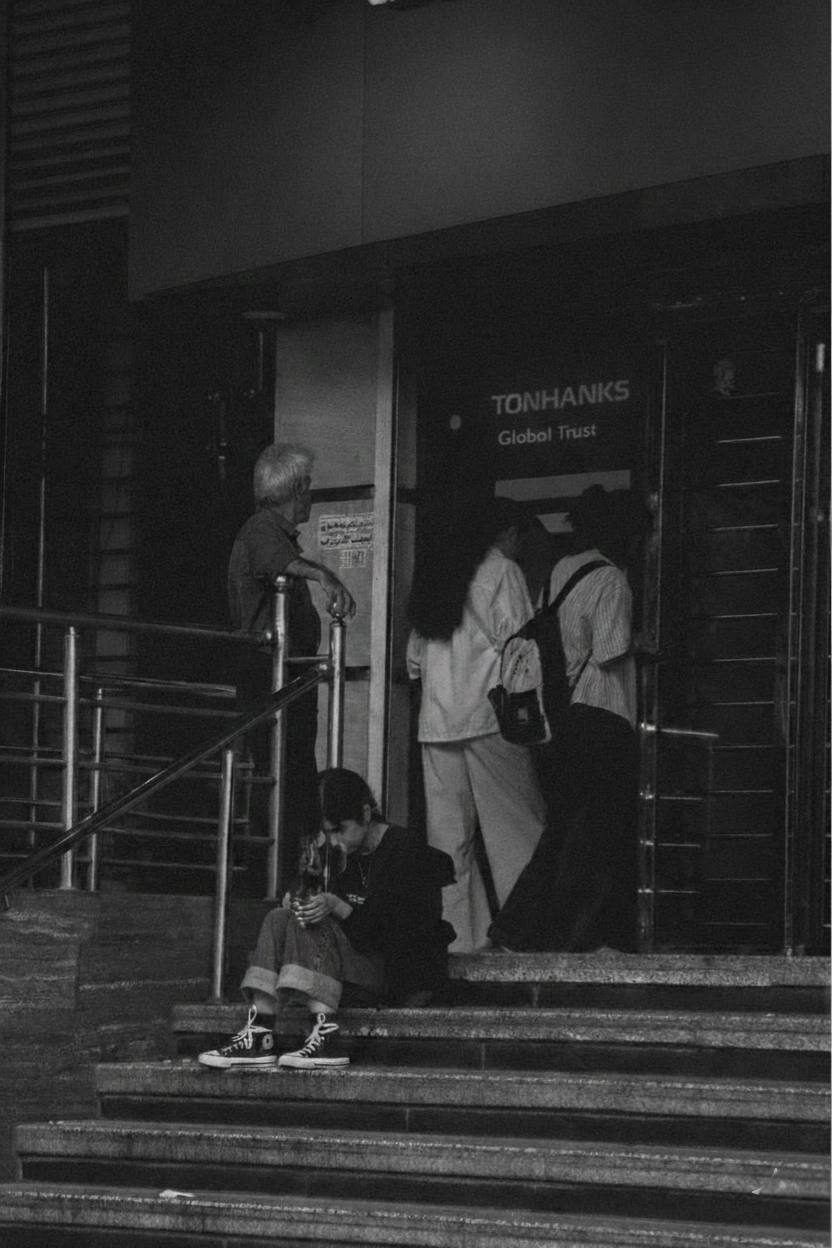

Building for the Long Term

TONHANKS Global Trust Financial Group is a leader in investment banking, financial services for consumers and small businesses, commercial banking, and asset management. We operate as a critical bridge between the generations of wealth, ensuring that our clients have the agility to navigate the modern economy while maintaining the security of traditional asset preservation.

We are a modern Fintech powerhouse built for every generation. For the established generation, we provide the rock-solid stability and institutional-grade security of a traditional trust. For the new generation of digital entrepreneurs, we deliver the high-velocity, borderless technology required to thrive in a 24/7 global marketplace. At Tonhanks, legacy meets innovation.

Our Visionary Mission

We believe that capital is a tool for progress. Our mission is to democratize institutional-grade financial products, bringing the same level of security and growth once reserved for sovereign funds to individuals and startups across 180 countries.

We recognize that today’s investors range from those managing lifelong legacies to those launching the next digital revolution; our platform is designed to serve both with equal precision.

Our foundation is built on absolute integrity. We recognize that our success is tied directly to the success of our clients and the communities we serve. By blending Fintech agility with traditional banking trust, we continue to invest in the stability of our global infrastructure, ensuring your capital is protected by the most advanced institutional-grade protocols while remaining accessible at the speed of a single click.

Comprehensive Banking Solutions

We provide a full suite of products meticulously curated to accompany you through every milestone. From high-tier checking and savings with institutional fraud protection to specialized professional loans, we prioritize your long-term growth.

Our Debt Relief programs assist qualified individuals in restructuring their obligations, providing a compassionate, solution-oriented path to reclaiming financial sovereignty.

Global Currency Excellence

The Tonhanks Multi-Currency Platform allows you to hold and earn interest in over 180 local currencies. This eliminates the friction of international trade and protects your liquidity from the volatility of exchange markets.

For our North American clients, our Premier Savings accounts offer a market-leading 4.50% APY, combining the security of a traditional account with the yield of an active investment.

Asset & Legacy Protection

Our Integrated Insurance Accounts are designed as interest-bearing productive assets. We utilize insurance as a tool for retirement planning and estate preservation, ensuring that your family’s standard of living is protected for generations.

What sets us apart is the growth potential: specific policies are designed to generate interest gains of up to 40%, making your protection a high-yield investment vehicle.

Catalyzing Innovation: Start-Up Hub

Our Angel Investor & Start-Up Account is engineered to be the definitive ecosystem for the next wave of global innovation. We recognize that the greatest barrier to technological progress is often the friction between high-net-worth liquidity and early-stage capital requirements. At Tonhanks Global Trust, we have solved this by creating a direct pipeline for Angel Investors to mobilize wealth from their investment stock portfolios and redirect it into pre-seed and seed-stage startups without the traditional delays of third-party brokerage settlements.

As a trusted fiduciary, our role extends far beyond the simple transfer of assets. We act as an institutional safeguard for both the benefactor and the visionary. For the Angel Investor, we provide absolute transparency: we monitor every disbursement from the account to ensure that funds are strictly utilized for the development milestones, R&D cycles, and scaling objectives agreed upon in the initial funding term sheet. This level of oversight mitigates the inherent risks of early-stage investing, ensuring that the founder’s ambition remains aligned with the investor’s capital.

For the startup, this account serves as a credibility engine. Having your pre-seed funds managed and monitored by an institutional leader like Tonhanks signals to future Series-A investors that your financial operations are transparent and professionally audited. Furthermore, our integrated stock-to-capital bridge allows investors to liquidate specific portions of their high-growth portfolios and move those funds instantly into the startup's operational account. This frictionless movement of capital ensures that founders can spend less time on "the pitch" and more time on product development, secure in the knowledge that their funding is as stable as it is scalable.

By bridging the gap between established market wealth and the innovators of tomorrow, we are not just facilitating transactions—we are protecting the future of global industry. Whether you are an investor looking to diversify your legacy into the next unicorn, or a founder ready to change the world, the Tonhanks Start-Up Hub is your strategic command center.